Africa is at the cusp of a transformation. With the African Continental Free Trade Area (AfCFTA) unlocking a $3.4 trillion market, the continent presents an unprecedented opportunity for startups to scale beyond borders. Yet, for many founders, the road to regional expansion remains riddled with challenges—regulatory complexities, fragmented markets, and the high cost of scaling operations.

However, here’s the truth, the companies that master cross-border expansion today will be the giants of tomorrow.

The African Market Is Ripe for Growth

With 54 markets and 1.3 billion people, Africa is the world’s next frontier for business. The growth in intra-African trade from 15% to 52% by 2030 signals a shift toward a more unified market.

As Africa continues to develop its digital economy, access to regional and international markets will play a key role in startup success. Entrepreneurs must stay ahead by identifying sectors where demand is growing, such as fintech, agritech, and e-commerce. With the right approach, Africa’s startup ecosystem will drive innovation and economic empowerment across the continent. Let’s discuss some key areas that every startup and investor should be looking at.

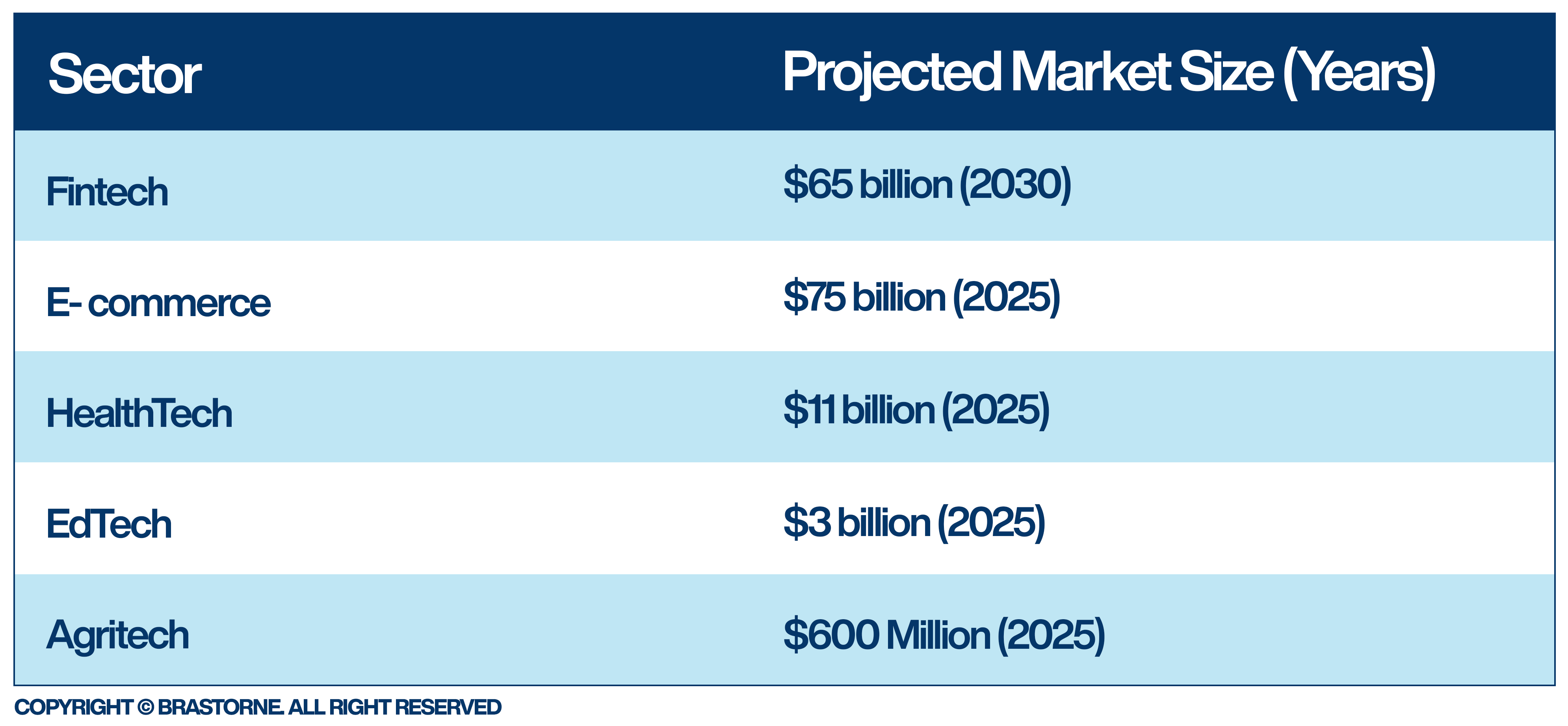

High-Growth Sectors for Startups & Investors

Africa’s startup ecosystem is set for exponential growth, with fintech ($65B) and e-commerce ($75B) leading the charge. HealthTech, EdTech, and Agritech are also scaling, transforming essential industries. With AfCFTA unlocking a $3.4T market, startups that act now will shape Africa’s digital future.

The key to success lies in understanding where the opportunities are. High GDP growth, rapid digital adoption, and a business-friendly regulatory environment are critical indicators of a promising market.

Flutterwave, for example, focused on high-remittance markets where digital payments were already gaining traction. The result? A successful expansion across Africa and beyond, but beyond fintech, startups in sectors like e-commerce and agritech are leveraging mobile technology to reach untapped markets, providing services tailored to unique local needs.

Understanding the growth trajectories of different industries within African markets is crucial for a sustainable expansion strategy.

The Playbook for Regional Expansion

Leveraging Regional Economic Groups

Organizations like ECOWAS (West Africa), EAC (East Africa), and SADC (Southern Africa) provide frameworks that simplify cross-border trade. These groups offer benefits like harmonized trade policies, common payment systems, and shared infrastructure, reducing friction in scaling businesses across regions.

However, while these groups create enabling environments, startups must also develop deep, localized market knowledge. Partnering with key stakeholders, including logistics providers, financial institutions, and government agencies, will ensure smoother operations across regions. Additionally, understanding consumer behavior in different markets will allow companies to offer products and services that resonate with local audiences.

The Role of Fintech, USSD, and Inclusivity

Financial inclusion is a game-changer for startups. With 67% of mobile users relying on USSD & mobile money, companies that integrate local payment solutions will gain a competitive edge. Jumia’s success in multiple countries is partly due to its strategic adoption of mobile money and cash-on-delivery options, boosting transaction completion rates by 40%.

Beyond fintech, USSD (Unstructured Supplementary Service Data) technology is driving digital inclusion. While many African consumers lack smartphones or consistent internet access, USSD provides an accessible way to conduct transactions, access services, and engage with businesses. This is particularly significant in rural areas, where traditional banking infrastructure is lacking.

Inclusivity must be at the heart of Africa’s digital transformation and by leveraging USSD, startups can ensure their services reach the widest possible audience. One startup that is doing this well is Brastorne, reducing the digital divide and enabling millions to participate in the growing digital economy. Whether in financial services, agriculture, or education, USSD offers a cost-effective, scalable solution for ensuring that no one is left behind.

Building Local Partnerships for Market Entry

No startup can expand in isolation. Strategic alliances with local businesses, governments, and distribution networks will accelerate market entry and growth. Twiga Foods, for instance, collaborated with agricultural boards to streamline its logistics, reducing costs and improving efficiency.

Brastorne has long understood this, partnered with Orange and is currently impacting over 5 million African lives in Botswana, Zambia, DRC, Cameroon and Guinea eroding the barriers to digital inclusion in the agricultural industry.

Establishing a strong local presence also includes working with community leaders, leveraging informal networks, and employing local talent who understand the market dynamics and by embedding themselves within the local economy, startups will gain invaluable trust and insight, which are critical to long-term success.

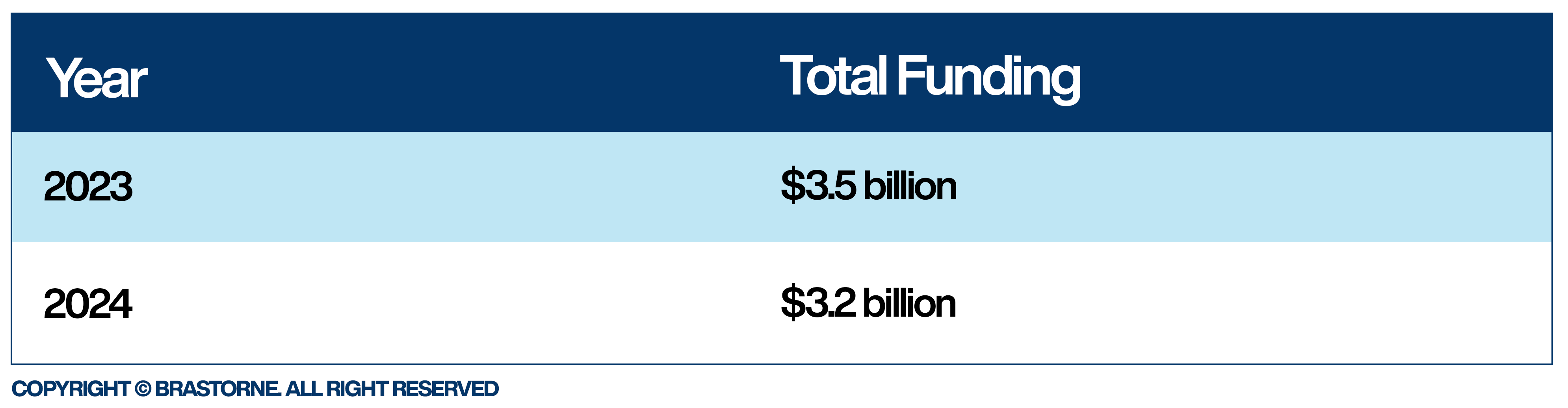

Securing Funding for Expansion

African startups secured $3.2 billion in funding in 2024, marking a decrease from $3.5 billion raised in 2023. The drop reflects shifting investor sentiment and economic challenges affecting funding globally.

The funding landscape suggests that investors are becoming more selective, prioritizing startups with scalability, profitability, and impact-driven solutions. Despite the slowdown, Africa remains a high-potential market, especially for fintech, agritech, and e-commerce solutions that align with mobile-first economies.

Expansion requires capital. Whether through venture capital, impact investors, or development banks, securing the right funding is critical. Investors increasingly favor startups that demonstrate scalability and social impact—aligning with Africa’s growing demand for technology-driven solutions in agriculture, health, and finance.

Are you investor-ready? Startups should prepare strong investment pitches that showcase their adaptability to local markets, as well as their ability to navigate cross-border challenges.

The Future for African Startups

With AfCFTA lowering barriers, now is the time for bold, data-driven expansion strategies. Companies that prioritize market research, compliance, cultural adaptation, and strategic partnerships will emerge as the leaders of Africa’s economic revolution.

African entrepreneurs have an unparalleled opportunity to scale their impact. The question is—will your startup seize this $3.4 trillion opportunity? Those who take decisive action today will lead the continent’s economic transformation in the years to come.